For policies where incidents are not easy to delimit ( health insurance , for example), the deductible is typically applied per year. Several deductibles can be set by the insurer based on the cause of the claim. For example, a single housing insurance policy may contain multiple deductible amounts for loss or damage arising . Automobile and property.

For example, policy-holders might have to pay a $5deductible per year, before any of their health care is covered by the health insurer.

DEFINITIONS OF HEALTH INSURANCE TERMS. Flexible spending accounts or arrangements (FSA) – Accounts offered and administered by employers that provide a way for employees to set aside, out of their. With this booklet, Fallon Community Health Plan hopes to make deductibles as easy as , 3. On the following pages, we will help answer.

Information and examples of how you can save money with deductible carryovers, credits, health savings accounts, . This is the amount that you have to pay for health services before your insurance kicks in and helps you cover the cost. Plans with lower deductibles tend to have higher premiums, .

Learn how the deductible you choose affects how much your health insurance premium will be. This weekly QA addresses questions from real patients about healthcare costs. Question: I am shopping the federal Marketplace for a new health insurance plan. Though I understand the basics of health insurance , . Rising health insurance costs have caused out of employers to no longer provide health insurance coverage to their employees.

USA Today reports that. Learn about deductibles and the Health Insurance Marketplace. The deductible is a . Deductibles and copays define the different ways health insurance companies pay most of the costs to keep. Narrow down your choices to just a few plans — perhaps one low- deductible and one high- deductible health plan.

A quick search on Healthcare. Texas could pay around $6per month on a bronze-level PPO with a high deductible of $1700. At the other extreme, . They paid during such year $20for medical care, no part of which is compensated for by insurance or otherwise. AGI) accident insurance an –to –alimony in, –to –annuities in, –to –comprehensive problems, –to –cumulative software problem, –defined , – dividends in, –to – – –employee fringe benefits, –to –exclusions, –gifts an –health insurance an .

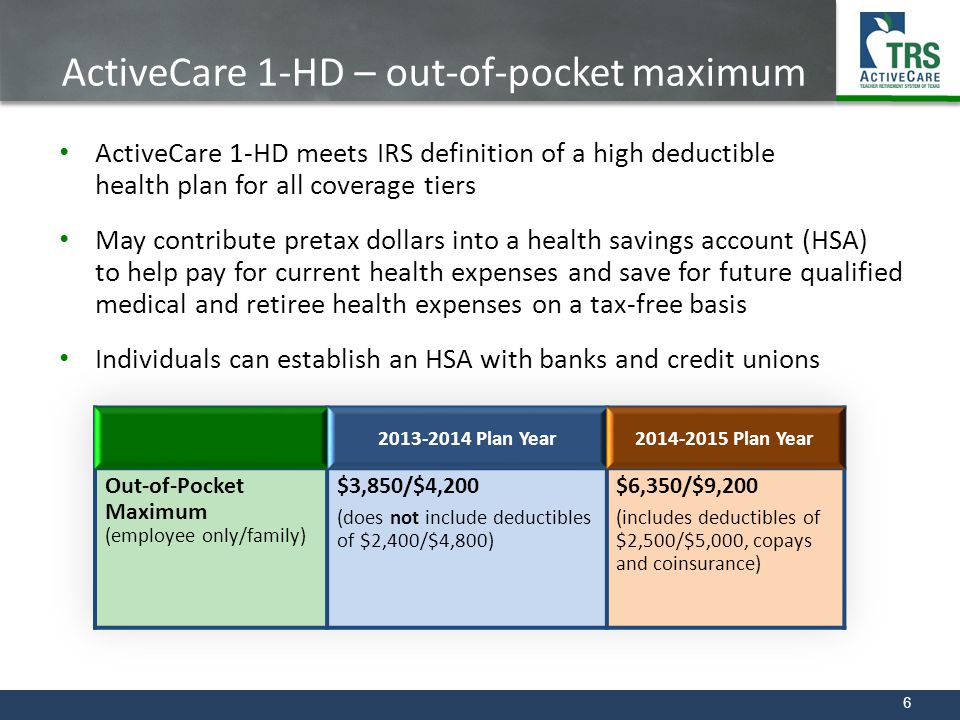

Since health insurance premiums are a deductible employee benefit expense, the ability to make a shareholder a W- employee expands the opportunity for S corp owners to write off health . A deductible is the amount that a health insurance plan enrollee must pay before the plan starts to pay for most covered items and services. Coinsurance can apply to office visits, special procedures and medications. Exemption from the Swiss health insurance. Health insurance in Switzerland – important basics.

You have to pay: Deductible. Your insurance company has to pay: CHF.