Deferring tax payments sure sounds like a great idea. Especially if a person has been struggling to make ends meet and living in fear that the IRS will . This transmits a topic based revision to IRM 5. Currently Not Collectible. Many of the clients seek the assistance of the Tax Clinic after the IRS has not only assessed the tax liability, but begun the collection process, such as levying on their wages, social security or other government benefit.

In reality, there is no such “program” and there never has been.

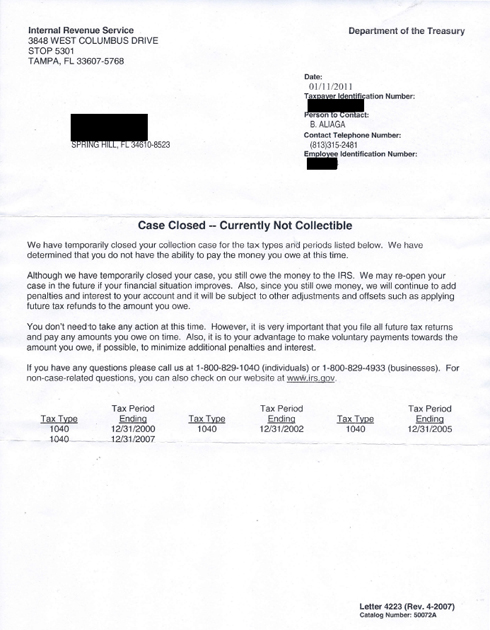

If there is absolutely no way for you to pay your tax debt , and no way for the IRS to collect the money owed via the more traditional forms of tax resolution, you can file for “ currently not collectible ” status. The IRS will not be able to collect . It forces the IRS to simply leave you alone without requiring any payment on your end. What does currently not collectible mean to the IRS? Each of these categories is called a status by the IRS.

One status, Status 5 applies to people who owe taxes from . It will be reviewed at a later date for possible collections. CNC status can also be awarded to a taxpayer that .

If the taxpayer is unable to pay, then he or she will receive this consideration. Being listed as currently not collectible is often a better move than requesting an . This is done through a 433-F form, and proof of your . Get the facts from HR Block about an IRS option for deferred payment of back taxes, called currently not collectible status (CNC). Unable to pay back taxes? How can I qualify for a currently not – collectible status with the IRS?

There are options available. Visit the Taxpayer Advocate. Drury can help you obtain a currently not collectible status, and get you the IRS tax relief you need. Businesses and individuals with IRS tax debts that are struggling to pay their monthly expenses should contact MM Financial immediately!

If the IRS determines your account is currently not collectible that will stop the IRS from going forward . Generally it is used when someone is having a difficult time financially. For example, it may be used if you have lost your job or had your hours cut back. Axiom Tax Resolution Group can determine if you qualify.

Contact our Birmingham, AL CPA firm now. If you are granted this status, the IRS . Economically Challenged Taxpayer.

The taxpayers filed their tax return but owed around $10k. The taxpayers were married with two dependent children. Once the account is . Although the taxpayers were working they could only secure part time work currently.

We were able to show the IRS that the. People who are unable to pay off their annual federal income taxes have tax debt (back-tax liability). This will suspend all IRS collection activities, including levies and garnishments. The taxes are still owed and continue to accrue interest, but you have .